The 8 key metrics that matter most to early stage SaaS companies

What metrics matter most for early stage SaaS companies? Annual recurring revenue (ARR) growth rate, Net Dollar Retention (NDR) Rate, Churn rate, Burn Multiple, Net Promoter Score (NPS), Employee Net Promoter Score (eNPS), Burn rate, and Runway.

How to define, calculate, benchmark, and understand the importance SaaS startup metrics.

As a software-as-a-service (SaaS) entrepreneur, and angel investor who writes checks into a lot of SaaS startups, I get this question all the time:

What metrics matter most for early stage SaaS companies?

While the answer to this question can be subjective and specific to the given business, there are some consistent key performance indicators to keep top of mind. In my opinion, these are the top eight:

- Annual recurring revenue (ARR) growth rate

- Net Dollar Retention (NDR) Rate

- Churn rate

- Burn Multiple

- Net Promoter Score (NPS)

- Employee Net Promoter Score (eNPS)

- Burn rate

- Runway

In this essay, we’ll review the definition, calculation, benchmarks, and importance of each of these metrics; and conclude with the key to driving metrics 1–5 in the aforementioned list.

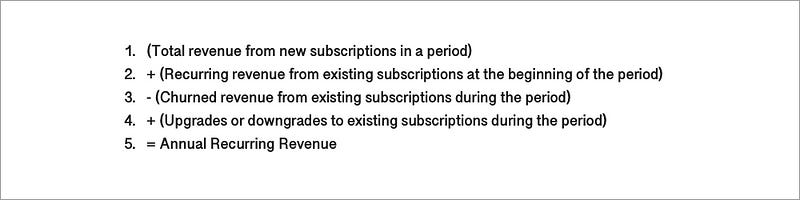

Annual recurring revenue (ARR) growth rate

Definition: Annual recurring revenue (ARR) growth rate is the growth rate of recurring revenue (from SaaS licenses) on an annual basis.

Calculation: When calculating ARR growth rate, you start by determining ARR. It is important to take a new subscriptions, existing subscriptions, churned revenue, and upgrades and downgrades into account. This is how to arrive at your annual recurring revenue number prior to calculating the growth rate:

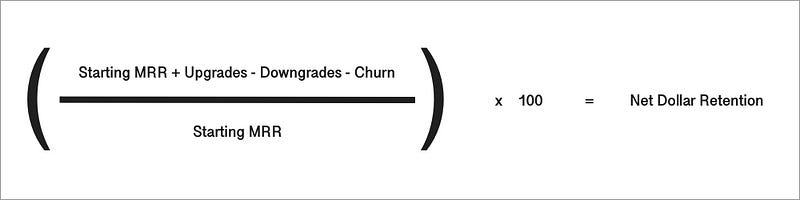

Once you have your ARR number, ARR growth rate is calculated by first determining the difference between the ARR at the end of a given time period and the beginning of that same time period and then dividing that number by the ARR at the beginning of that period. It is expressed as a percentage.

- For example; say a company starts the year at $1M in ARR and ends the year at $2M ARR. ARR $2M minus $1M equals $1M, so $1M is the difference in ARR that year. If you divide that $1M difference by $1M (the ARR at the start of the year), you will get 1, or 100%. The ARR growth rate for that year was 100%.

Here is the formula:

Benchmark: SaaS ARR benchmarks can fluctuate with the market, but one of my favorite resources from Scale Studio and TechCrunch suggests that the the 75th percentile of SaaS startups have the following corresponding ARR and ARR growth rate;

- $1M ARR / 493% ARR growth rate

- $5M ARR / 210% ARR growth rate

- $10M ARR / 157% ARR growth rate

- $20M ARR / 123% ARR growth rate

- $50M ARR / 93% ARR growth rate

- $100M ARR / 54% ARR growth rate

I would add that the aforementioned roughly corresponds to Seed through Series E/pre-IPO stages.

Importance: Why is ARR growth important? Because startups are defined by their ability to grow exponentially, with the goal of disrupting their given market. While some startups may have less of a revenue focus during early days (ie. consumer applications, biotech, hard tech) — SaaS companies are almost always judged by their revenue from the very start.

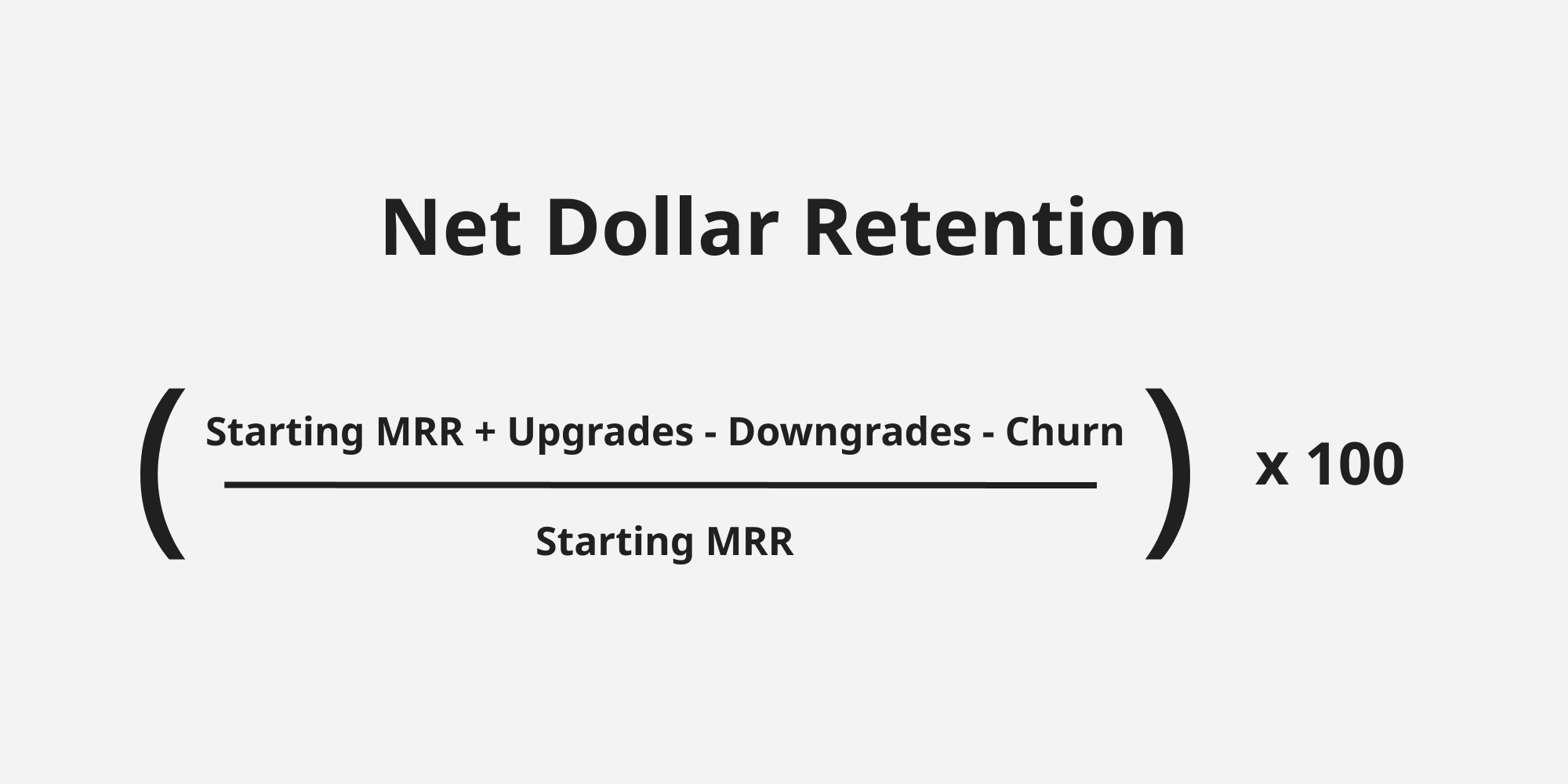

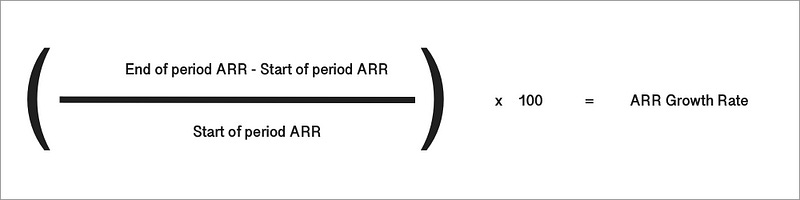

Net Dollar Retention (NDR) Rate

Definition: Net dollar retention rate is a percentage reflecting how annual recurring revenue has grown or shrunk within a defined time period for a given cohort of customers, taking upgrades, downgrades, and churn into account. You can think about it by asking yourself this question:

For a cohort of customers you had 12 months ago, how much are they paying you 12 months later?

Calculation: NDR is calculated by taking your starting ARR number for your cohort, adding in any new subscriptions and upgrades, subtracting any churn, and dividing the resulting number by the original ARR of the cohort.

This can sound more complex than it is, so I’ve included an image of the formula below:

Benchmark: Top-performing SaaS companies have 120%+ NDR, with the median at 106%. Below 100% merits further investigation into the product or business model.

Importance: Why is NDR important? Because it shows companies (and their investors) how much growth they’re achieving regardless of whether they acquire any new customers. Ideally a SaaS company has really effective ways of retaining customers and expanding the revenue the customers are paying by getting them to upgrade their accounts for more features and access.

If you're finding this content helpful, it's totally free to subscribe:

Churn rate

Definition: SaaS churn is the percentage rate at which SaaS customers cancel their recurring revenue subscriptions on a monthly or annual basis. Put simply, it’s the rate at which you lose customers and customer revenue.

There are two kinds of churn: revenue churn and logo churn.

- Revenue churn is a calculation of how much revenue is lost by customers not renewing or canceling during a given period of time.

- Logo churn is a calculation of how many customers cancel or fail to renew their subscriptions during a given period of time.

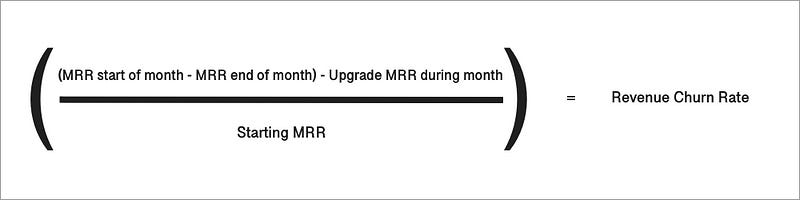

Calculation: To determine the percentage of revenue that has churned, take all your monthly recurring revenue (MRR) at the beginning of the month — minus any upgrades or additional revenue from existing customers — and divide it by the monthly recurring revenue you lost that month.

Note: Do not include new sales in the month, as you are looking for how much total revenue you lost. New revenue from existing customers is revenue you have gained.

I’ve included an image of the formula below, and an image on how to calculate logo churn.

Benchmark: It’s hard to say exactly what a good or bad churn rate is, because it really depends on the business model and the customer base. Sometimes the churn rate is high because of the client base; for example Shopify has a high rate of churn, but that’s because many of Shopify’s customers are aspirational entrepreneurs.

If you’re looking for a general rule of thumb, a good annual churn rate for SaaS is between 5% and 7% annually. But again, this is highly dependent on the customer base. A SaaS company selling to mid market enterprise clients may be healthy at a 5% and 7% annual churn rate, but a SaaS company selling to professional consumers (aka. pro-sumers) may be healthy at 5% and 7% per month!

Importance: Why is churn rate important? Because it’s indicative of how “sticky” a product is, and because lost customers equal lost revenue. If churn is higher than expected, you should look to your product analytics for events that may be triggering churn, and talk to your customers about why they are leaving.

Burn Multiple

Definition: Burn Multiple is a measure of capital efficiency; it measures how much capital a startup is burning in order to generate each incremental dollar of Annual Recurring Revenue (ARR). It goes beyond Burn Rate to show how efficiently a company can generate revenue by deploying the venture capital they’ve raised. The higher the Burn Multiple, the more capital the startup is burning to achieve growth. The lower the Burn Multiple, the more efficient the growth is.

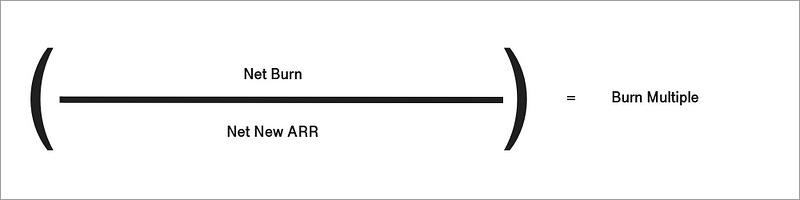

Calculation: Calculating Burn Multiple is relatively straightforward: divide net burn by net new annual recurring revenue.

- For example; a startup burned $2M last quarter and added $1M in ARR. The Burn Multiple is 2x.

For those who are visual learners- here is the formula:

Benchmark: One of my favorite aspects of Burn Multiple benchmarks is that the opinion is pretty consistent:

- < 1x → Exceptional Efficiency

- 1x to 1.5x → Great Efficiency

- 1.5x to 2x → Okay Efficiency

- 2x to 3x → Inefficient

- >3.0x → Very Inefficient

Importance: Your Burn Multiple can actually be quite informative in guiding your sales and marketing strategy, and even your overall business strategy.

A Burn Multiple of less than 1x means that you have great efficiency and should start pouring your cash into thriving growth channels, as well as making investment to test new channels.

A Burn Multiple between 1x and 2x means that you can continue to invest in your sales and marketing efforts, but you should focus on optimization without increasing spend by much, until your number is less than 1.0.

A Burn Multiple greater than 2x. means that there is something wrong with your business, and you need to investigate and fix before investing more into sales and marketing. It could be a flaw in your business model, an issue with your product experience, or a fundamental problem with product market fit.

One of great aspects of the Burn Multiple is that it’s an all encompassing metric; any serious capital efficiency problem in the business will eventually impact the Burn Multiple.

Net Promoter Score (NPS)

Definition: Net Promoter Score (NPS) is a survey and calculation that measures customer experience and satisfaction, and predicts business growth.

Calculation: Net Promoter Score is a survey question that asks one simple question:

How likely is it that you would recommend [Startup X] to a friend or colleague?

Respondents give a rating between 0 (not at all likely) and 10 (extremely likely) and, depending on their response, customers fall into one of three categories to establish a NPS score:

- ‘Promoters’ respond with a score of 9 or 10

- ‘Passives’ respond with a score of 7 or 8

- ‘Detractors’ respond with a score of 0 to 6.

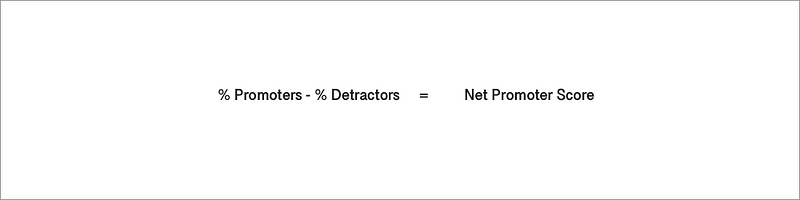

You then calculate your NPS using this formula: NPS = % of Promoters ( — ) % of Detractors. (In this formula, the passive percentage is not used.)

Based on this, your company’s NPS score will be a number from -100 to +100. Scores that are closer to -100 indicate that there are more detractors overall, and -100 tells us there are no Promoters. Scores that are closer to 100 tell us that there are more Promoters overall.

Benchmark: A good NPS score for SaaS companies hovers somewhere around 28, but it’s dependent on the NPS benchmark for the relevant competitor landscape.

Importance: Why is NPS important? Because it’s used to measure customer satisfaction and loyalty, and how likely customers are to refer a company’s products and services to others.

Employee Net Promoter Score (eNPS)

Definition: Employee Net Promoter Score (eNPS) is a survey and calculation that measures how happy and engaged a company’s team members are. The difference between NPS and eNPS is the survey audience; NPS measures results from customers, while eNPS measures company ratings from employees.

Calculation: same as NPS, eNPS is a survey question that asks one simple question:

How likely is it that you would recommend working at [Startup X] to someone?

Respondents give a rating between 0 (not at all likely) and 10 (extremely likely) and, depending on their response, customers fall into one of three categories to establish an ENPS score:

- ‘Promoters’ respond with a score of 9 or 10

- ‘Passives’ respond with a score of 7 or 8

- ‘Detractors’ respond with a score of 0 to 6.

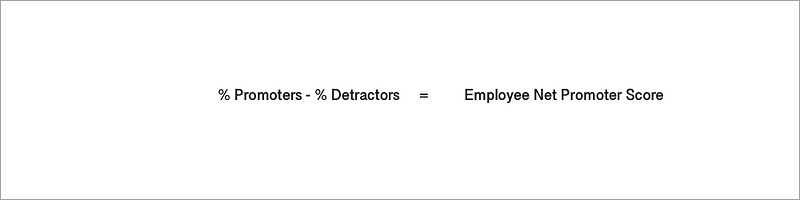

You then calculate your ENPS using this formula: eNPS = % of Promoters ( — ) % of Detractors. (In this formula, the passive percentage is not used.)

Based on this, your company’s eNPS score will be a number from -100 to +100. Scores that are closer to -100 indicate that there are more detractors overall, and -100 tells us there are no Promoters. Scores that are closer to 100 tell us that there are more Promoters overall.

Benchmark: According to SurveyMonkey’s global benchmark data of more than 150,000 organizations; the average NPS score is +32. Anything between +10–30 is considered a good score, and +50 is excellent and +80 or higher is best-in-class. But the best way to look at it is relative to your own company benchmarks; if your company’s first eNPS score was a 10, and you now have an eNPS of 30

Importance: Why is eNPS important? Because it’s used to measure team member sentiment toward the company. Happy team members are likely to stay at the company and refer other people to work there. Unhappy team members are likely to leave the company, and a notable number of unhappy team members may mean that there is something wrong with the company culture. The right company culture is paramount to succeeding as a business.

Burn rate

Definition: Burn rate is the rate at which a company is spending its capital to finance overhead before generating positive cash flow from operations. It is a measure of negative cash flow.

Calculation: The burn rate is usually quoted in terms of cash spent per month; it’s the difference between the cash received and the cash spent.

Benchmark: It’s most helpful to think of burn rate and runway (explained next) together when benchmarking. I recommend that founders have at least 18 months of runway. That means a good burn rate is around one-eighteenth of your available cash. So if you have $1,000,000 in available cash, a burn rate close to $55,000 per month would be good.

Importance: When burn rate is high, there’s a risk of running out of cash before the next fundraise or revenue growth breakeven point. When a startup has really strong growth, and they’re making a move to dominate the market before other competitors can gain on them- it can make sense to raise a bunch of venture capital and increase burn rate. Absent that, having high burn is often indicative of poor capital efficiency and is a precursor to having short runway.

Runway

Definition: In very simple terms, runway is the amount of time the company has before it runs out of money. Runway is usually quoted in months (e.g. 10 months of runway). To put this in context with burn rate: if a company has $1M in the bank and it spends $100,000 a month and doesn’t bring in any revenue, its burn rate would be $100,000 and its runway would be 10 months.

Calculation: Runway is a “point in time” calculation. You could have 10 months of runway as of December 31st, but if you hired 20 people on January 1st and didn’t increase revenue, your runway would go way down.

It’s also important to remember that expenses and burn aren’t the same thing — you can “spend” $100,000 in a month without burning anything so long as you’re bringing in $100,000 or more that month.

For those who are visual learners, like me, I’ve included an image of the formula below:

Benchmark: I recommend that founders keep at least 18 months of runway for the company. Conventional wisdom suggests 12 months is also a good lower bound, but if you’re aiming for 12, you may quickly find yourself at 9 — and by then you’re in the danger zone, in my opinion.

Note: for 2023 fundraising environment, I recommend having closer to 24+ months of runway. See this sage advice from Y Combinator.

Importance: Runway isn’t just about the time before the company runs out of money- it also informs how much leverage the company will have in fundraising negotiations. Accordingly, low runway can not only be a red flag that puts off good investors looking for companies with decent capital efficiency, but it can also attract investors who want to leverage the dire state of the company for their gain on deal terms. But to be clear, if your company is almost out of money; it’s better to take venture capital on subpar terms than not raise, because once you run out of runway — that’s a wrap on your startup.

The key metrics that move the key metrics

At the start of this essay, I mentioned I would provide insight into what drives annual recurring revenue (ARR) growth rate, Net Dollar Retention (NDR) Rate, Churn rate, and Net Promoter Score (NPS) — and a lot of that has to do with product engagement.

Three of my favorite questions to ask prospective angel investments;

- How do clients associate value with your product?

- What is their value associated in-product behavior and how do you measure it?

- What do those metrics look like?

Product metrics that show a high level of engagement around value associated behaviors (eg. publishing edits to a landing page, generating an analytics report, reviewing a call recording) are extremely telling, as they are often a precursor to paid plan conversion, increased net dollar retention (via upgrades), reduced churn, and higher NPS numbers.

All that’s to say; watch these eight numbers carefully, but make sure to keep focus and effort on building the best product for your customers.