How to run a strategic seed round process

A big part of what makes Seed rounds unique is the SAFE note (popularized by Y Combinator), and the ability to increase the “cap” (read: “valuation”) to drive investment pressure. Here is a step by step guide for a strategic Seed round.

Step-by-step guide on how to use the SAFE note to create leverage for a faster close

The Seed round is arguably my favorite round, both as an angel investor and former operator.

We raised our Seed round for Shogun just prior to Y Combinator Demo Day Winter 2018. It was a $2.1M Seed with participation from some great angel investors, smaller funds, and “led” by our first-choice Seed investor — Initialized Capital. We used an escalating cap on a SAFE note strategy and the whole process only took a few weeks. We’d later go on to raise another $113M from Insight Partners, Accel, Initialized, VMG, and Y Combinator through priced rounds- but the uniqueness of Seed rounds always stayed top of mind for me when giving advice to prospective angel investments.

A big part of what makes Seed rounds unique is the SAFE note (popularized by Y Combinator), and the ability to increase the “cap” (read: “valuation”) to drive investment pressure. Despite this advantage, it surprises me how few founders optimize their process to capitalize on the opportunity. I won’t make any more puns in this piece, but I will:

(1) Provide a step-by-step guide on how to maximize the SAFE note and create momentum in your Seed round process.

(2) Give several key bits of advice to mull over as you execute your Seed round strategy.

Strategic Seed round process, step-by-step

- Make a long list of investors in 3 categories: (1) angel investors (2) micro VC/small funds (3) institutional VC.

- You can find a lot of angel investors via Linkedin, search the title “angel investor”. On Angel.co, and Crunchbase you can look up companies you admire and find their investors via the “Funding” fields. Exited and late stage company Y Combinator alums are also often angel investors.

- You can use similar tactics to find smaller VC and funds. Whether it’s micro VC firms ($10M or less funds) or syndicated angels — find investors that are more than just one person’s money.

- Make a long list of early stage institutional VC. These are proper firms with significant fund sizes (hundreds of millions or billions). Many VC firms that used to invest at “venture” stage, now invest in “early stage”. Lists of these firms are easy to find via Google search. Look up the partner that focuses on your sector.

2. Contact all of the potential investors, but don’t cold open with the fundraise pitch.

- Tell them you’re gathering interest on raising, and let them know about your startup’s target market size and traction- for the latter, 3 metrics focused bullet points is a good default.

- Take an initial call with all of the investors, and ask them questions about their investment thesis, how they support their investments, etc.

- After the call, forward them a company performance memo or “investor update” to give them further insight into what you’re building- with performance data.

- Note: If you’re not at the point of tracking your key metrics, it means you’re pre-traction, and I recommend holding off on raising a Seed. More below.

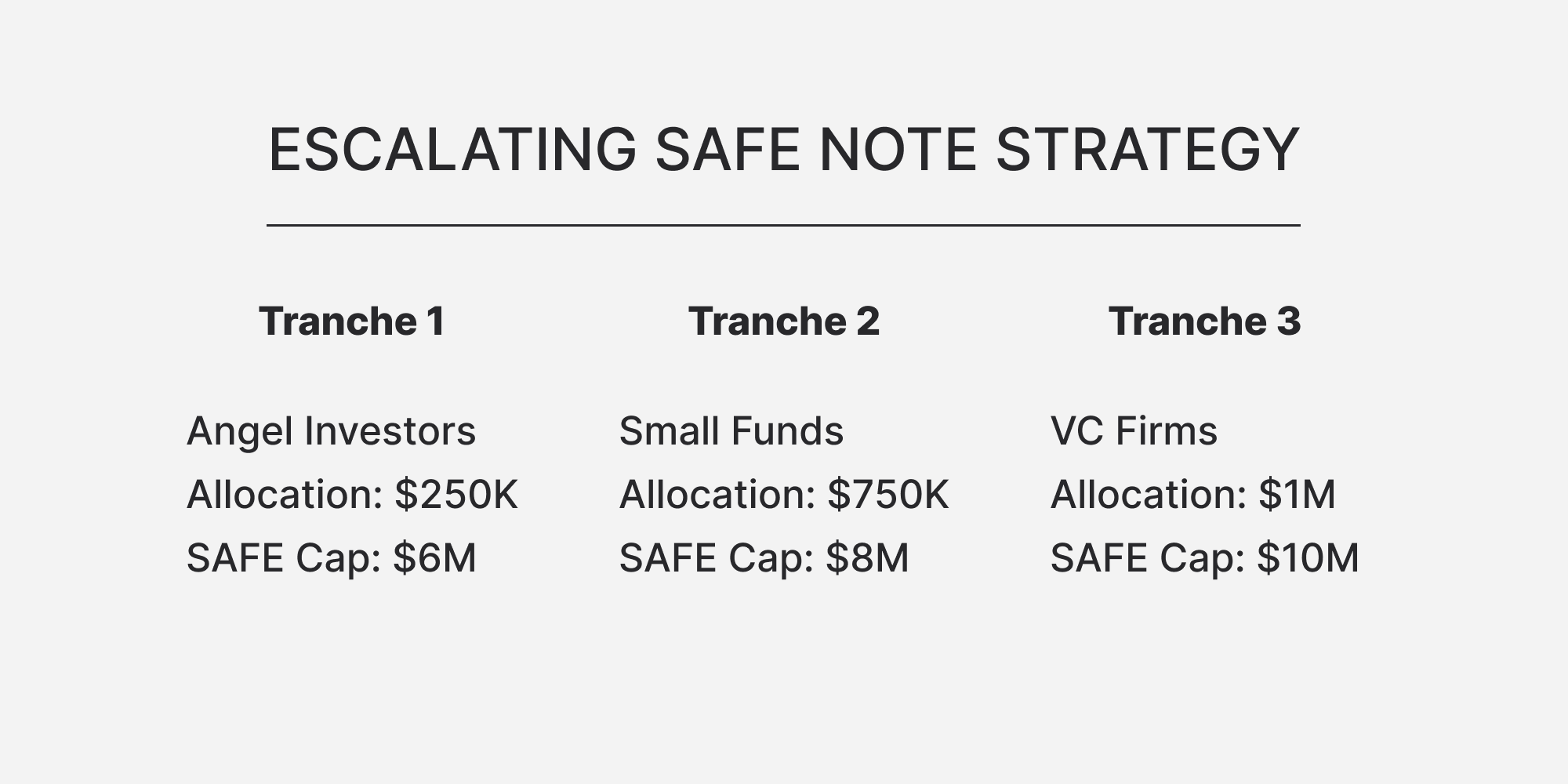

3. Decide on 3 caps and allocation amounts for your SAFE note.

- See versions of the SAFE note here. This defines the terms of your raise. The caps effectively set your valuation, and the tranches of allocation make up the amount of your fundraising round.

- You want to execute a strategy that leverages an escalating cap on a SAFE note to (ideally) drive investment pressure and faster close.

- Keep in mind that you can always increase the cap on the SAFE, but if someone has invested at a given cap, you should not be taking investment at a lower cap. TLDR; the cap is a 1 way door, and breaking that is considered poor business hygiene. More below.

- When you create your 3 caps and allocation amounts, it should look something like this (figures for demonstration purposes):

- Tranche 1: $250K at $6M cap — angels

- Tranche 2: $750K at $8M cap — micro VC, small funds, more angels

- Tranche 3: $1M at $10M cap — VC firms

- You’ll ideally take 1 week with each tranche, and close the whole round in 3 weeks.

- You should have a sense of how much interest there is based on how many calls you were able to book- consider that when setting your caps and allocation.

- Model your potential dilution on the round. It should be coming in around 20%, with a range of 15%-25%.

4. Tranche 1: Reach out to the Angel investors and offer them the first cap.

- Tell them you got more interest in your round than you anticipated (subjective), and you’ve decided to raise now.

- Send them your pitch deck, data, etc. and ask them if they have any questions. Let them know you’d be happy to jump on a call to discuss.

- Let them know that you really enjoyed your conversation and see them as an add value investor, and you want to offer them a lower cap on the SAFE.

- Let them know that there’s limited allocation of ${XXX}K and you’ll be raising the cap next week.

- When you’re 70% closed on Tranche 1 allocation, start updating the angels on the remaining allocation for that cap. But mention that there’s no pressure if they need more time to decide, and there will be more allocation on the next cap.

5. Tranche 2: Escalate your SAFE cap, and start reaching out to micro VC/small funds.

- Let them know that you got more interest in your round than you anticipated, and you’ve decided to raise now. Emphasize that you closed ${XXX}K in Y days from angel investors.

- Send them your pitch deck, data, etc. and ask them if they have any questions. Let them know you’d be happy to jump on a call to discuss.

- Let them know that you really enjoyed your conversation and see them as an add value investor, and you want to offer them a lower cap on the SAFE before settling on your final cap. Let them know that there’s limited allocation of ${XXX}K/${X}M and you’ll be raising the cap next week.

- You can continue to ping investors who are interested, but hesitating, with total amount raised and remaining allocation on Tranche 2 cap amounts.

6. Halfway through Tranche 2, reach out to the institutional VC.

- Let them know that you got more interest in your round than you anticipated, and you’ve decided to raise now. Emphasize that you closed ${XXX}K/${X}M in YY days from angel investors and smaller funds.

- Tell them you’ll be taking calls with VC firms next week, and would love the opportunity to pitch the decision making committee. Mention why you’re interested in their firm or leading partner specifically.

- Wrap up Tranche 2 with the smaller funds/ micro VC, and angels, letting them know that you’ll be taking calls with VC firms now, and will move to the final cap next week.

7. Tranche 3: Book all the VC firm meetings into a 1 week period. Escalate your SAFE cap. And close the round.

- Pitch the firms on a call, and send them your pitch deck, data, etc. afterwards as follow up and ask them if they have any additional questions.

- If they ask for follow up calls, that’s fine, but keep them to the deadline, and book for the same week. Keep the time pressure on.

- Politely mention that you’ve closed ${XXX}K/${X}M in YY days, and you expect the round to close soon. Let them know the remaining allocation.

- You don’t necessarily need to go with the first firm that comes back with a yes; you can ping the other firms and ask if they have made a decision, and pick your favorite firm. That said, get the round closed and get back to work, and don’t fall into a trap of a cap/valuation bidding war that could come back to bite you.

If you're finding this content helpful - it's totally free to subscribe:

Key Seed round advice

If you’re pre-traction, I recommend holding off on raising a Seed. If you try this strategy and it doesn’t work, it may be because you don’t have enough traction to be compelling to investors. If you’re in SaaS, try to get to $10K MRR or $100K ARR before raising. If you’re in consumer tech, get truly active users, in respectable volume. (Hardware and hardtech involve more capital expenditure, so it can make sense to raise with research and MVP development- but without additional traction.) I have yet to meet a startup who bootstrapped to their detriment, and it’s arguably the best approach to take in all situations. Can great teams with bold ideas playing in big TAMs raise on a narrative? Sure. But if you’re wrong in your hypothesis, you’ll lock yourself into pivoting until you diminish all the millions in funds from your Seed; from what I’ve observed, that’s a pretty stressful and depressing experience. If you validate first, before the Seed, you can also set yourself up for much better negotiation in priced rounds down the road. By bootstrapping a bit of traction, you start one step ahead essentially. If you really want to raise pre-traction, consider an accelerator like Y Combinator or Techstars instead — they will provide pre-Seed money as well as advice.

If you’re in an accelerator, run this strategy 3 weeks out from your “Demo Day”. Demo Day is a great forcing function, and I would argue it is much of the value these programs provide to startups. Investors are often motivated to find the best companies prior to the Demo Day, so they don’t miss out on allocation. All that said, after Demo Day, the FOMO fades considerably, possibly entirely. Start your Seed round fundraising process 3 weeks out from Demo Day and use it as a deadline and forcing function.

Aim for 20% dilution in your Seed round. Range of 15%-25%. As a rule of thumb, a Seed round is $1–3M in size, dilutes founders by about 20%, and provides enough resource to get the company to Series A. (Note: the amount needed to achieve Series A milestones may increase for hardware, hardtech, etc.). Consider how much money you need to get to Series A milestones (eg. $3–5M ARR at 200%+ YOY ARR growth rate for SaaS), and after you get an initial pulse on interest from “get to know you” calls with investors, set your fundraise amount and cap/valuation goals, and calculate the total amount of dilution you anticipate based on your 3 tranche strategy. More on how dilution with post money SAFEs works, here. If you’re coming in at notably more than 25%, you may want to focus on gaining more traction so you can have greater leverage in fundraising. If your dilution is coming in at less than 15%, ask yourself if your traction really justifies the cap/valuation, and if you think you’ll be able to grow into your valuation and 3–5x that value in time for your Series A. Speaking of which, you’ll want 12–18 months of runway when you start your Series A process to stay leveraged in investor negotiations, so you have less money than you think for growing into and surpassing your Seed valuation.

Create investor decision deadlines and stick to them. An investor’s default mode is to preserve optionality on a deal. Provided the terms won’t change, and allocation will be there, a smart investor will take the maximum amount of time you give them to make an investment decision. This is because they can use that time to research, backchannel, and mull over the opportunity to increase or decrease their certainty. Don’t give them uncapped time. Always set a decision deadline, or let them know when the terms of the deal will change (in your favor).

Never give a lower cap once you have taken money at a higher cap. I mentioned this earlier, but again; think of it as a 1 way door. You can increase the cap for new investors, but you cannot decrease the cap for them if a single executed SAFE has come in at a higher cap. That includes your friends, or that angel investor you really like, who dragged their feet last week when you gave them the lower cap, but now want in. No. They can only get in at the most recent cap. Be respectful to the people who have invested in you. If you end up in a situation where you raised your cap too early and are no longer getting enough demand to close, and you need to lower the cap: don’t freak out. Go back to those who committed at a higher cap and explain the situation. Ask them if they’re still interested in investing at the lower cap. Nullify the higher cap SAFE and issue them the new (lower) cap SAFE.

A note about taking money from VCs who have recently moved into Seed. Because of recent market dynamics, VCs who used to stick to Series A and B pre-2020 are now investing at Seed stage. Target these firms, but stick to SAFE notes — no priced rounds and no board seats.

Don’t get “greedy” on valuation, or you may hurt your Series A prospects. In my experience, Series A can be a tough round. Startups get the benefit of “promise” at Seed, which is a major benefit compared to other rounds. Series B and beyond can be quite formulaic depending on your business model and sector; unless your growth is in obvious decline, or there’s some other major red flag- it’s less of a question of whether you can raise a Series B or C, it’s more on what terms and at what valuation. The Series A however, can be this awkward mix of narrative and performance. It’s also often the first priced round for which you need a “lead” investor and formal legal and financial due diligence is performed. If your Seed valuation was obviously high, and you weren’t able to grow into it; Series A investors will take note. For some, it won’t be an issue- they’ll happily flat or downround you if they like the company a lot. For others, it may give them the impression that you oversell yourself and can’t back it up with growth. Stay humble, and consider putting more weight on the right investor and the right deal terms than the highest valuation.

If you haven’t already, it’s free to subscribe!