My 2022 angel investment thesis

Hello there!

My name is Nick, and I’m an entrepreneur, operator, and investor.

I’ve co-founded 2 companies — ecommerce software-as-a-service company Shogun (YC W18), and digital creative agency Glass + Marker.

I’m focused on Shogun, but having a bit of luck with business has given me the opportunity to invest in some amazing startups in my free time.

The purpose of this article is to give a transparent look into my angel investment thesis for 2022 - in case you’re interested in working with me.

My startup investment experience:

My startup investments include:

Alto Pharmacy (Seed); Narrator.ai (Series A); Depict.ai (Seed); Fathom Video (Seed); Gorgias (Series B); Alba Orbital (Seed); CaptivateIQ (Series B); Deel (Series C); Vitally.io (Series A); Canvas (Seed); Navattic (Seed); Treble.ai (Seed); Cointracker (Series A); DEX Screener (Seed); Maverick (Seed); Givebutter (Seed).

I’m also a Limited Partner in Initialized Capital (Fund VI); and a Venture Partner in Pioneer Fund (Alumni Fund 2022).

Choosing the right investors is important, so please feel free to perform due diligence on me. Beyond Google searches, you can find me on Linkedin, and Twitter, and you can also ask a Y Combinator partner or alumni about me.

What I look for in a startup:

- I invest in SaaS, and moonshots. But mostly SaaS.

- I define moonshots as tech companies that are a potential paradigm shift for a given sector (e.g. Boom, SpaceX, Solugen, Netflix, Instacart, Cruise, Bedrocan, etc.) or developing locale.

- I invest in Seed, Seed-extension, and Series A rounds, with a slight preference for Seed-extension.

- For SaaS, I look to invest in companies with vital metrics above or around the 75% percentile; the article Measuring and benchmarking the four vital signs of SaaS is good reference in that regard. I’m pretty focused on velocity, so ARR volume and growth rate will be my main focus. Great net dollar retention can also be very compelling.

While there can be exceptions to the aforementioned, I’ll likely stick hard and fast to this for the remainder of 2022. If your investment opportunity doesn’t quite match these criteria, but you still want to get in touch- please know that I keep an open mind, and am always appreciative of getting “a look” at a deal.

What I offer to startups in return:

- Founder empathy and peer mentorship. I’ve been an operator (founder) for 11 years. I’ve bootstrapped 2 companies from zero to 7 figures in annual revenue, and I’ve grown a company to 8 figures in annual recurring revenue. Startups are hard- I fully understand that my investment is likely to go to zero. Whether you’re thriving or failing; I’ll be there if you’d like my help. That said, sometimes founders prefer investors to invest and then be completely hands off — and I can appreciate that as well.

- Scaling/company building advice. Tying hiring plans to goals/OKRs, hiring at the right level (according to the stage of the startup), change management. Stuff like that. I’ve scaled companies from 0 to close to 200 team members, and I have organizational learnings I’ll be happy to share.

- SaaS best practices. Best practices for low and high touch SaaS models, product led growth (PLG), and go-to-market motions (Shogun Page Builder is low to high touch SaaS, Shogun Frontend is high touch). Personalized review and advice on metrics that matter for SaaS company health, and optimal fundraising.

- Navigating pivots. At the outlay in Spring 2015, Shogun was a page builder for Rails web applications. But that didn’t go so well. In Fall of 2015, we pivoted to become a page builder for Shopify, and by 2017 Shogun had become a page builder for ecommerce platforms, generally (i.e. Shopify, BigCommerce, Salesforce Commerce Cloud, etc.). And in 2019 we innovated a completely new product; an ecommerce focused “frontend-as-a-service ” platform. I believe pivots are less of a scary thing, and more of a common characteristic of successful startups.

- Structured advice and co-working sessions for fundraising process. Most of my investments appreciate advice and collaboration on running a successful fundraise process. Fundraising is hard, and the way that you structure your process, and how you negotiate on terms, matters a lot. With Shogun, we bootstrapped to $1.2M ARR, and then raised:

- a pre-seed from Y Combinator (Winter 2018 batch)

- a $2.1M seed from initialized in 2018

- a $10M Series A from initialized and VMG in 2019

- a $35M Series B from Accel in 2020

- a $67M Series C from Insight Partners in 2021

A note on the unit economics of tech startup investing:

2020 and 2021 were a pretty crazy time for startups and fundraising. Valuations got out of control. The risk to reward ratio got wonky. There has been a market correction as a result.

While I don’t agree with all of the opinions the author expresses- the Techcrunch article The meeting that showed me the truth about VCs, is a great visual guide on the economics of venture capital.

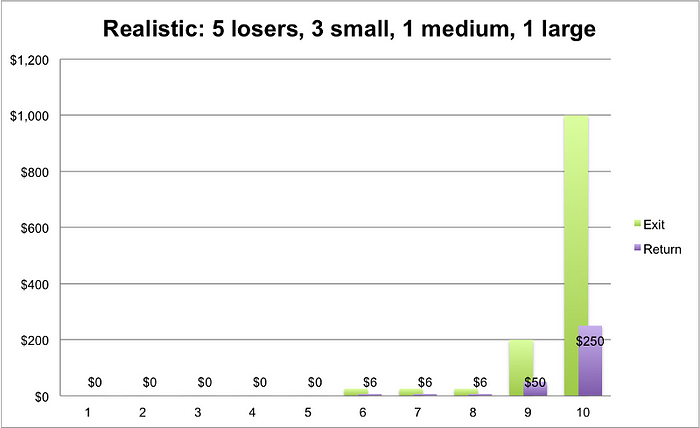

This is the game that (smart) VC and angel investors play:

Note that (1) green marks the exit size (2) purple marks the payout amount of the VC with their 25 percent and (3) numbers are expressed in millions.

In short, venture returns are power law distributed. With every investment I consider, I have to ask myself if this investment has the potential to be the rare exception in my portfolio.

In closing

My interest in investing in startups goes beyond financial gain.

In 2016, when things were looking grim for my startup - a good friend recommended I read The Monk and the Riddle by Randy Komisar. It gave me a real appreciation for the kind of mentorship value angel investors can provide.

As I watched the startup fundraising market get out of control in 2020 and 2021 (with many firms offering early stage companies eye-watering valuations); I wondered if there was still viable opportunity for angel investors. It made me sad to think that the era of true angel investing in Silicon Valley was coming to a close.

Perhaps a silver lining from the market correction will be the re-emergence of founder to founder funding and mentorship.

Thank you for taking the time to read my 2022 investment thesis, and I hope to have the honor of considering an investment in your company.